All Categories

Featured

Table of Contents

One more sort of benefit debts your account equilibrium periodically (yearly, as an example) by setting a "high-water mark." A high-water mark is the highest value that a mutual fund or account has reached. Then the insurance provider pays a survivor benefit that's the greater of the present account worth or the last high-water mark.

Some annuities take your initial investment and instantly add a certain portion to that amount yearly (3 percent, as an example) as a quantity that would certainly be paid as a death advantage. Variable annuities. Beneficiaries after that obtain either the actual account value or the initial investment with the yearly boost, whichever is better

For instance, you could choose an annuity that pays for ten years, yet if you pass away prior to the 10 years is up, the staying settlements are guaranteed to the recipient. An annuity death advantage can be handy in some situations. Below are a couple of instances: By aiding to prevent the probate process, your beneficiaries may obtain funds quickly and easily, and the transfer is personal.

How do I cancel my Annuity Contracts?

You can commonly pick from a number of alternatives, and it's worth exploring all of the choices. Pick an annuity that operates in the manner in which finest helps you and your family members.

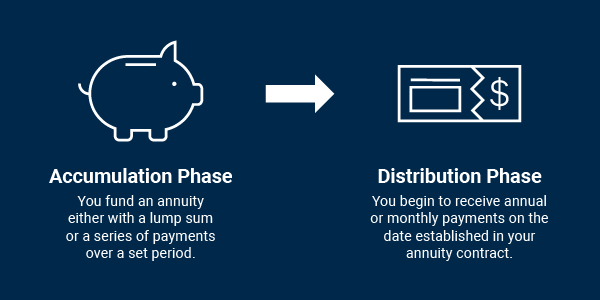

An annuity aids you gather cash for future revenue demands. The most suitable usage for income payments from an annuity agreement is to fund your retirement.

This product is for educational or instructional purposes just and is not fiduciary financial investment recommendations, or a safeties, investment technique, or insurance policy item recommendation. This product does rule out an individual's very own purposes or conditions which ought to be the basis of any kind of investment decision (Retirement annuities). Investment items may undergo market and other danger variables

Why is an Annuity Investment important for my financial security?

All assurances are based on TIAA's claims-paying capability. Fixed vs variable annuities. TIAA Conventional is an assured insurance agreement and not an investment for government safety and securities law objectives. Retired life settlements refers to the annuity income received in retirement. Assurances of repaired regular monthly payments are only related to TIAA's repaired annuities. TIAA may share revenues with TIAA Typical Annuity owners via declared added quantities of passion during accumulation, higher preliminary annuity earnings, and via additional rises in annuity revenue advantages during retired life.

TIAA might give a Commitment Perk that is just readily available when electing lifetime earnings. Annuity agreements may contain terms for keeping them in pressure. TIAA Conventional is a fixed annuity item provided with these agreements by Teachers Insurance coverage and Annuity Association of America (TIAA), 730 Third Avenue, New York, NY, 10017: Form series including however not limited to: 1000.24; G-1000.4; IGRS-01-84-ACC; IGRSP-01-84-ACC; 6008.8.

Converting some or every one of your savings to earnings benefits (described as "annuitization") is a long-term choice. When income benefit payments have begun, you are unable to transform to another alternative. A variable annuity is an insurance policy agreement and consists of underlying financial investments whose value is connected to market efficiency.

Annuities For Retirement Planning

When you retire, you can pick to receive earnings forever and/or various other earnings alternatives. The actual estate sector goes through numerous dangers including fluctuations in underlying home values, costs and income, and prospective environmental liabilities. As a whole, the value of the TIAA Real Estate Account will rise and fall based upon the hidden worth of the direct real estate, actual estate-related financial investments, real estate-related protections and liquid, set revenue investments in which it invests.

For a more complete discussion of these and other threats, please get in touch with the program. Liable investing incorporates Environmental Social Governance (ESG) variables that might influence exposure to companies, fields, industries, restricting the kind and variety of investment possibilities available, which might cause leaving out investments that perform well. There is no guarantee that a diversified portfolio will enhance general returns or outmatch a non-diversified profile.

You can not invest straight in any index - Fixed-term annuities. Other payment alternatives are available.

There are no charges or fees to initiate or stop this function. Nevertheless, it is necessary to keep in mind that your annuity's balance will be minimized by the earnings settlements you receive, independent of the annuity's efficiency. Revenue Examination Drive revenue settlements are based upon the annuitization of the amount in the account, duration (minimum of 10 years), and other elements chosen by the individual.

Who offers flexible Annuity Interest Rates policies?

Any kind of warranties under annuities issued by TIAA are subject to TIAA's claims-paying ability. Transforming some or all of your cost savings to revenue benefits (referred to as "annuitization") is a permanent choice.

You will have the alternative to name several recipients and a contingent recipient (someone designated to receive the cash if the main beneficiary passes away prior to you). If you do not call a recipient, the accumulated possessions can be surrendered to an economic institution upon your fatality. It is essential to be aware of any financial effects your recipient might encounter by acquiring your annuity.

As an example, your spouse can have the choice to transform the annuity agreement to their name and end up being the brand-new annuitant (known as a spousal continuation). Non-spouse recipients can not continue the annuity; they can just access the designated funds. Minors can not access an inherited annuity up until they turn 18. Annuity proceeds might exclude a person from obtaining government benefits - Annuity contracts.

Who should consider buying an Annuity Contracts?

Upon death of the annuitant, annuity funds pass to an appropriately called beneficiary without the delays and costs of probate. Annuities can pay survivor benefit several various methods, depending on terms of the agreement and when the fatality of the annuitant occurs. The option selected effects just how taxes schedule.

Assessing and upgrading your selection can help guarantee your wishes are executed after you pass. Choosing an annuity beneficiary can be as complicated as selecting an annuity to begin with. Luckily, you don't require to make these difficult choices alone. When you speak to a Bankers Life insurance policy agent, Financial Agent, or Financial Investment Expert Agent who gives a fiduciary standard of treatment, you can feel confident that your choices will certainly help you develop a strategy that offers protection and tranquility of mind.

Table of Contents

Latest Posts

Who offers flexible Fixed Indexed Annuities policies?

How can an Tax-deferred Annuities help me with estate planning?

What should I look for in an Income Protection Annuities plan?

More

Latest Posts

Who offers flexible Fixed Indexed Annuities policies?

How can an Tax-deferred Annuities help me with estate planning?

What should I look for in an Income Protection Annuities plan?