All Categories

Featured

Table of Contents

Note, however, that this does not state anything about changing for rising cost of living. On the plus side, even if you think your option would certainly be to purchase the stock exchange for those 7 years, which you would certainly get a 10 percent yearly return (which is far from certain, especially in the coming years), this $8208 a year would be greater than 4 percent of the resulting small stock value.

Instance of a single-premium deferred annuity (with a 25-year deferment), with four settlement choices. Courtesy Charles Schwab. The monthly payment right here is highest possible for the "joint-life-only" alternative, at $1258 (164 percent greater than with the immediate annuity). However, the "joint-life-with-cash-refund" choice pays out just $7/month less, and guarantees at least $100,000 will certainly be paid.

The means you acquire the annuity will certainly establish the response to that inquiry. If you buy an annuity with pre-tax bucks, your premium decreases your taxed earnings for that year. According to , buying an annuity inside a Roth plan results in tax-free payments.

Immediate Annuities

The consultant's initial step was to create a detailed economic prepare for you, and afterwards explain (a) how the proposed annuity fits into your general strategy, (b) what choices s/he considered, and (c) just how such alternatives would or would certainly not have actually led to reduced or higher settlement for the advisor, and (d) why the annuity is the superior choice for you. - Long-term care annuities

Certainly, a consultant might try pressing annuities even if they're not the finest suitable for your scenario and goals. The reason can be as benign as it is the only product they offer, so they fall prey to the typical, "If all you have in your tool kit is a hammer, pretty soon whatever starts appearing like a nail." While the consultant in this scenario might not be underhanded, it increases the risk that an annuity is an inadequate selection for you.

How do Lifetime Income Annuities provide guaranteed income?

Since annuities commonly pay the representative marketing them a lot greater payments than what s/he would get for investing your cash in shared funds - Guaranteed income annuities, not to mention the no compensations s/he would certainly obtain if you invest in no-load shared funds, there is a huge incentive for agents to push annuities, and the more difficult the far better ()

A deceitful advisor recommends rolling that amount into new "better" funds that just take place to lug a 4 percent sales tons. Accept this, and the consultant pockets $20,000 of your $500,000, and the funds aren't most likely to do far better (unless you picked a lot more improperly to start with). In the very same example, the expert might steer you to purchase a complex annuity keeping that $500,000, one that pays him or her an 8 percent payment.

The advisor hasn't figured out exactly how annuity repayments will certainly be exhausted. The consultant hasn't revealed his/her settlement and/or the costs you'll be billed and/or hasn't revealed you the influence of those on your ultimate payments, and/or the settlement and/or costs are unacceptably high.

Existing interest prices, and thus predicted settlements, are traditionally reduced. Even if an annuity is appropriate for you, do your due diligence in contrasting annuities sold by brokers vs. no-load ones offered by the releasing company.

What does an Retirement Annuities include?

The stream of month-to-month payments from Social Protection is comparable to those of a postponed annuity. A 2017 relative evaluation made an extensive comparison. The complying with are a few of the most significant factors. Given that annuities are volunteer, the people buying them normally self-select as having a longer-than-average life span.

Social Security advantages are totally indexed to the CPI, while annuities either have no inflation defense or at a lot of offer an established percentage annual increase that may or may not compensate for rising cost of living in complete. This kind of rider, just like anything else that raises the insurance firm's threat, requires you to pay more for the annuity, or accept lower repayments.

Why is an Immediate Annuities important for long-term income?

Please note: This post is meant for informative objectives only, and ought to not be considered economic suggestions. You ought to seek advice from a financial professional before making any significant financial choices.

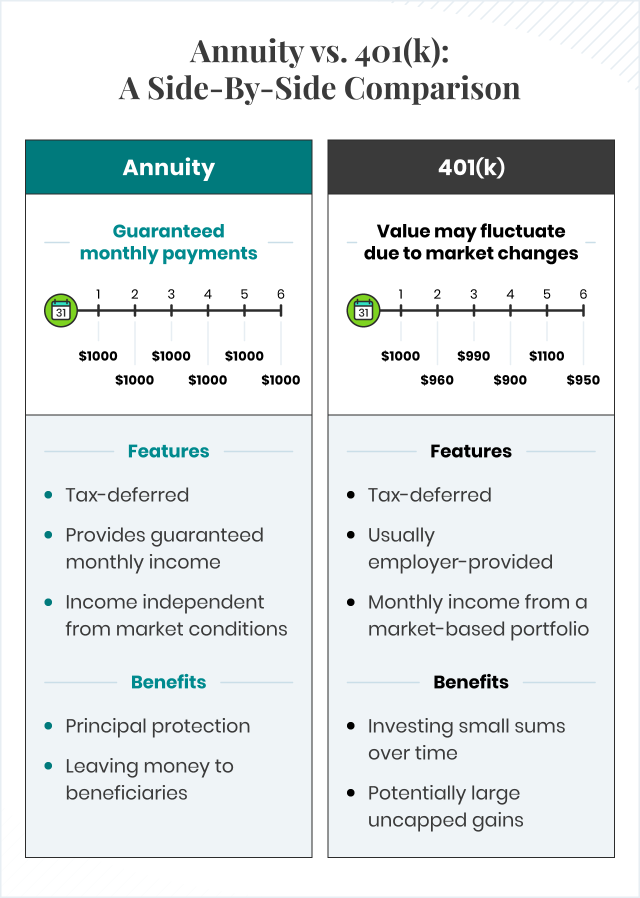

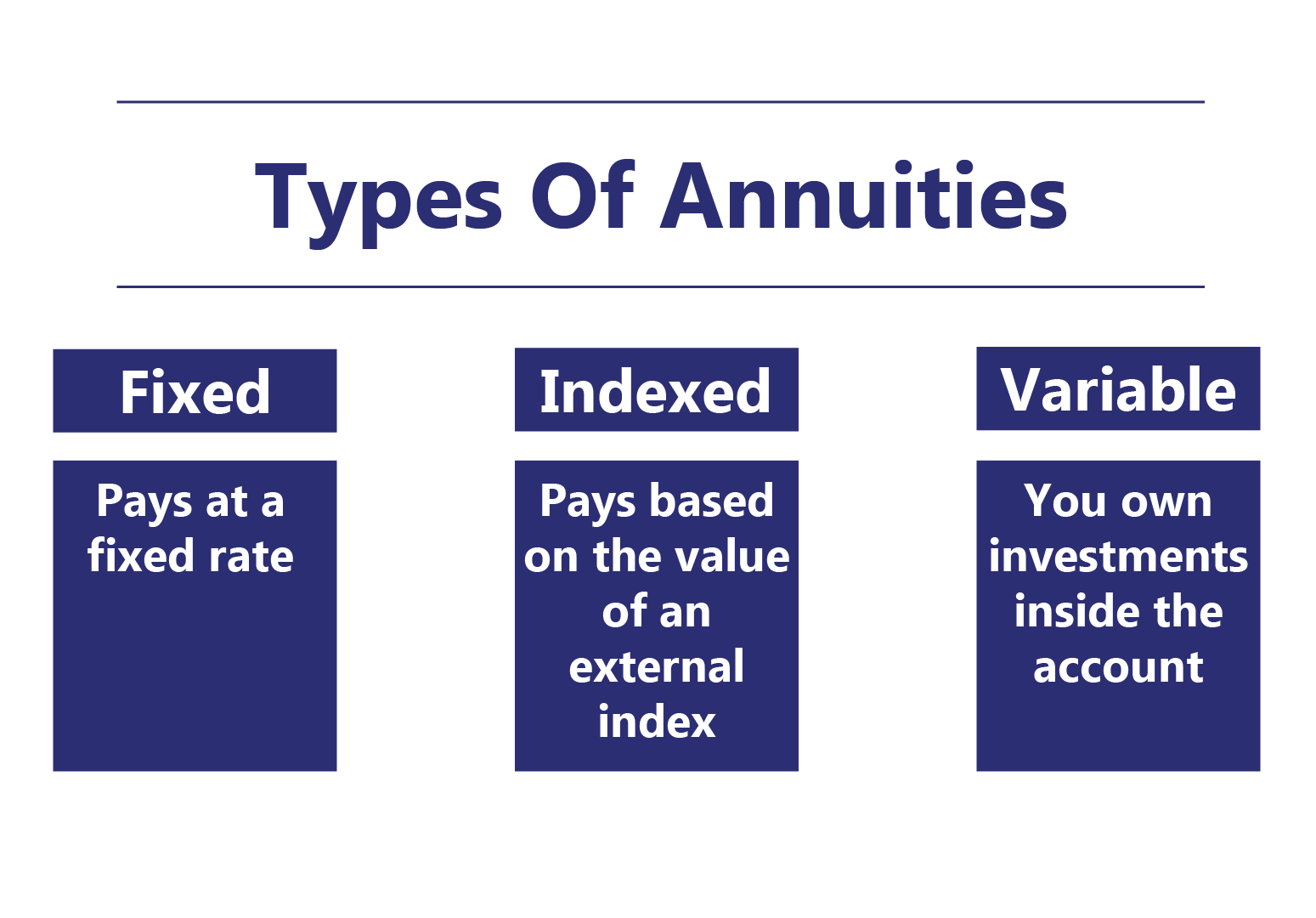

Because annuities are planned for retired life, tax obligations and charges might use. Principal Protection of Fixed Annuities. Never shed principal due to market efficiency as fixed annuities are not purchased the marketplace. Also during market slumps, your cash will certainly not be influenced and you will certainly not shed cash. Diverse Financial Investment Options.

Immediate annuities. Deferred annuities: For those that desire to expand their cash over time, but are eager to delay access to the cash up until retired life years.

Is there a budget-friendly Annuity Contracts option?

Variable annuities: Offers higher capacity for development by spending your cash in financial investment options you select and the capability to rebalance your profile based upon your preferences and in a manner that straightens with changing monetary goals. With dealt with annuities, the business spends the funds and supplies a rate of interest to the customer.

When a death case occurs with an annuity, it is essential to have actually a called recipient in the contract. Various alternatives exist for annuity survivor benefit, relying on the agreement and insurance provider. Selecting a refund or "period certain" option in your annuity offers a death advantage if you pass away early.

How do I apply for an Fixed Indexed Annuities?

Naming a recipient apart from the estate can aid this procedure go extra smoothly, and can aid make sure that the proceeds go to whoever the individual desired the cash to head to rather than undergoing probate. When present, a survivor benefit is instantly included with your contract. Relying on the kind of annuity you buy, you might have the ability to add enhanced death benefits and attributes, however there can be extra expenses or charges connected with these add-ons.

Table of Contents

Latest Posts

Understanding Financial Strategies Everything You Need to Know About Fixed Income Annuity Vs Variable Growth Annuity What Is the Best Retirement Option? Benefits of Choosing the Right Financial Plan W

Highlighting Fixed Income Annuity Vs Variable Growth Annuity A Comprehensive Guide to Retirement Income Fixed Vs Variable Annuity Breaking Down the Basics of Investment Plans Features of Smart Investm

Understanding What Is A Variable Annuity Vs A Fixed Annuity A Closer Look at How Retirement Planning Works Defining the Right Financial Strategy Advantages and Disadvantages of Variable Annuities Vs F

More

Latest Posts