All Categories

Featured

Table of Contents

On the various other hand, if a client needs to attend to a special demands youngster that might not be able to manage their own cash, a count on can be added as a recipient, allowing the trustee to handle the circulations. The kind of beneficiary an annuity owner selects impacts what the recipient can do with their acquired annuity and exactly how the proceeds will be strained.

Numerous contracts permit a partner to establish what to do with the annuity after the proprietor dies. A partner can change the annuity agreement into their name, presuming all regulations and rights to the initial agreement and postponing immediate tax repercussions (Annuity investment). They can gather all continuing to be repayments and any type of survivor benefit and select recipients

When a partner becomes the annuitant, the partner takes over the stream of repayments. This is referred to as a spousal extension. This stipulation enables the enduring partner to preserve a tax-deferred status and safe long-lasting economic stability. Joint and survivor annuities likewise allow a called recipient to take control of the agreement in a stream of payments, as opposed to a lump sum.

A non-spouse can only access the marked funds from the annuity owner's preliminary agreement. In estate preparation, a "non-designated recipient" refers to a non-person entity that can still be named a beneficiary. These include counts on, charities and various other organizations. Annuity owners can pick to assign a depend on as their beneficiary.

What is an Secure Annuities?

These differences designate which beneficiary will certainly receive the entire survivor benefit. If the annuity proprietor or annuitant dies and the key recipient is still alive, the main recipient receives the survivor benefit. However, if the key beneficiary predeceases the annuity owner or annuitant, the death benefit will certainly most likely to the contingent annuitant when the owner or annuitant passes away.

The owner can transform recipients any time, as long as the contract does not need an irreversible beneficiary to be named. According to professional factor, Aamir M. Chalisa, "it is very important to understand the value of marking a beneficiary, as selecting the incorrect recipient can have major effects. Much of our customers select to call their minor kids as recipients, frequently as the primary recipients in the lack of a spouse.

Proprietors that are wed need to not presume their annuity automatically passes to their partner. When picking a beneficiary, think about aspects such as your partnership with the individual, their age and just how inheriting your annuity could affect their monetary scenario.

The recipient's partnership to the annuitant usually figures out the regulations they adhere to. For example, a spousal recipient has even more choices for managing an inherited annuity and is dealt with even more leniently with taxation than a non-spouse recipient, such as a child or various other relative. Annuity payout options. Expect the proprietor does choose to name a kid or grandchild as a recipient to their annuity

How do Annuity Interest Rates provide guaranteed income?

In estate preparation, a per stirpes classification defines that, ought to your beneficiary die prior to you do, the recipient's offspring (children, grandchildren, and so on) will obtain the fatality advantage. Get in touch with an annuity expert. After you have actually selected and called your beneficiary or beneficiaries, you need to remain to review your choices at the very least annually.

Maintaining your designations approximately date can make certain that your annuity will be handled according to your wishes ought to you die suddenly. A yearly testimonial, significant life occasions can prompt annuity proprietors to take another look at their beneficiary choices. "Somebody might wish to update the recipient designation on their annuity if their life scenarios alter, such as marrying or separated, having youngsters, or experiencing a death in the family," Mark Stewart, CPA at Step By Action Business, told To transform your recipient designation, you must reach out to the broker or representative that handles your agreement or the annuity carrier itself.

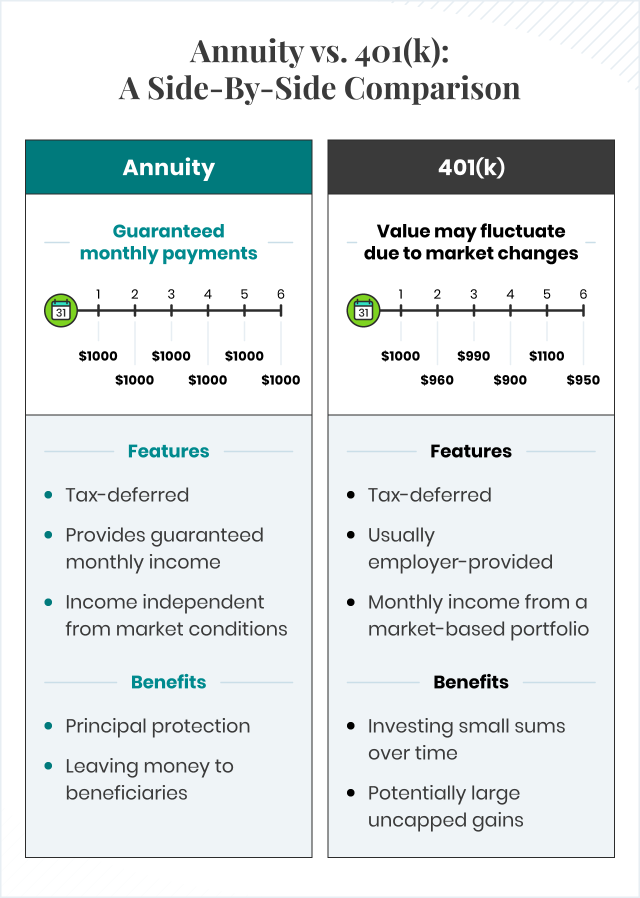

What is the difference between an Income Protection Annuities and other retirement accounts?

Just like any economic product, seeking the help of a financial advisor can be helpful. A financial organizer can guide you with annuity management processes, consisting of the techniques for updating your contract's recipient. If no beneficiary is called, the payout of an annuity's survivor benefit mosts likely to the estate of the annuity holder.

To make Wealthtender cost-free for readers, we earn cash from marketers, consisting of economic professionals and companies that pay to be included. This produces a conflict of passion when we prefer their promo over others. Wealthtender is not a customer of these financial solutions companies.

As a writer, it is among the most effective praises you can give me. And though I actually value any of you spending several of your busy days reading what I compose, clapping for my short article, and/or leaving praise in a remark, asking me to cover a topic for you absolutely makes my day.

It's you saying you trust me to cover a subject that is very important for you, and that you're certain I would certainly do so better than what you can already find on the internet. Pretty stimulating stuff, and a duty I do not take likely. If I'm not accustomed to the topic, I investigate it on the internet and/or with get in touches with who know even more regarding it than I do.

How can an Variable Annuities help me with estate planning?

In my good friend's instance, she was assuming it would be an insurance coverage of kinds if she ever goes right into nursing home treatment. Can you cover annuities in a short article?" Are annuities a legitimate referral, a wise step to protect surefire revenue for life? Or are they an unethical expert's way of wooling innocent customers by persuading them to move properties from their profile right into a complex insurance item pestered by too much charges? In the easiest terms, an annuity is an insurance product (that just certified agents might market) that guarantees you monthly settlements.

Just how high is the surrender fee, and how much time does it apply? This typically puts on variable annuities. The more cyclists you add, and the much less threat you're willing to take, the lower the payments you must expect to get for a given premium. Besides, the insurance company isn't doing this to take a loss (though, a bit like a gambling establishment, they're prepared to lose on some customers, as long as they more than offset it in greater revenues on others).

Who has the best customer service for Annuity Contracts?

Annuities chose appropriately are the ideal option for some people in some conditions. The only method to understand for certain if that includes you is to initially have a detailed financial plan, and then find out if any annuity alternative offers sufficient advantages to justify the costs. These expenses consist of the dollars you pay in costs of training course, yet likewise the possibility price of not spending those funds in different ways and, for a number of us, the effect on your ultimate estate.

Charles Schwab has a clever annuity calculator that shows you about what payments you can anticipate from dealt with annuities. I used the calculator on 5/26/2022 to see what a prompt annuity may payment for a single costs of $100,000 when the insured and partner are both 60 and stay in Maryland.

Table of Contents

Latest Posts

Understanding Financial Strategies Everything You Need to Know About Fixed Income Annuity Vs Variable Growth Annuity What Is the Best Retirement Option? Benefits of Choosing the Right Financial Plan W

Highlighting Fixed Income Annuity Vs Variable Growth Annuity A Comprehensive Guide to Retirement Income Fixed Vs Variable Annuity Breaking Down the Basics of Investment Plans Features of Smart Investm

Understanding What Is A Variable Annuity Vs A Fixed Annuity A Closer Look at How Retirement Planning Works Defining the Right Financial Strategy Advantages and Disadvantages of Variable Annuities Vs F

More

Latest Posts